- Trade Notification

Send and receive notifications of execution between venues and counterparties for trade booking and processing

- Give Up Messaging

Send block and allocation level trade details to Prime Brokers for give up processing

- Documentation Management

Collaborate, consolidate, automate, sign off and control credit-related documentation and agreements on one platform

- Trade Lifecycle Processing Focus

Automate trade processing, messaging and matching to confirm, allocate, clear and report trades

- Netting & Aggregation

Net or aggregate trades to reduce processing and settlement volumes and associated costs

- Cashflow Affirmation

Send, match and affirm cashflows to ensure streamlined settlement processing

- Collateral Management

Calculate, manage and automate collateral requirements across asset classes for maximum operational efficiency

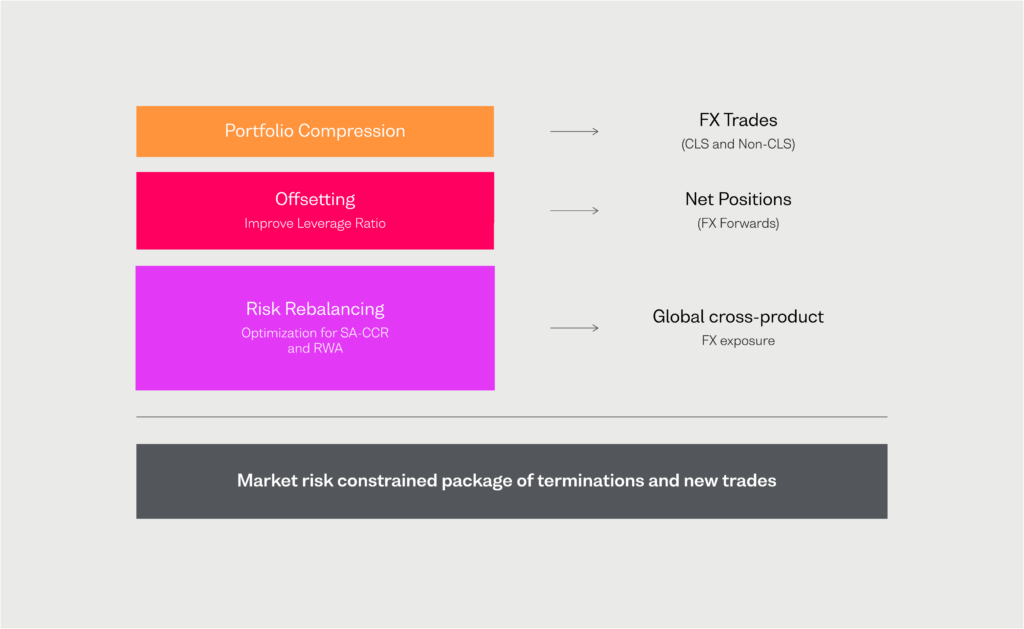

- Portfolio Compression

Compress OTC derivative portfolios on a multilateral basis, reducing capital and operational costs

- Counterparty Risk Optimisation

Reduce counterparty credit risk and funding costs via multilateral portfolio optimisation

- Basis Risk Optimisation

Offset and manage fixing and strike risk in trading portfolios through multilateral optimisation

- PvP Settlement Orchestration

Mitigate bilateral FX settlement risk, while optimising intraday funding and liquidity

- Benchmark Reform

Explore our suite of services supporting the industry move to new alternative risk free rates (RFRs).

- Complete Margin Management

Easily and efficiently manage your daily margin calls – including bilateral OTC, cleared, repo and ETD – all in one space.

- CSDR

Learn more about our range of services targeted at assisting your firm with post-trade processes relating to CSDR.

- Initial Margin Compliance

Meet your UMR obligations from IM calculation to collateral settlement, including threshold monitoring.

- Post-Trade Risk Reduction Services

Reduce systemic, operational and counterparty risk through portfolio compression, rebalancing and basis risk optimisation.

- SA-CCR

Optimise counterparty credit risk to proactively manage capital and funding exposures for OTC derivatives portfolios.